Think about your future now!

We get it, retirement planning can be scary, yet thrilling. Our guide is designed to empower and help you navigate through it. Starting your Individual Retirement Accounts (IRAs) now can lay a solid foundation for your golden years, offering flexibility and benefits distinct from employer-sponsored accounts such as a 401(k).

Like an oak tree from an acorn, start saving early with FCSB and begin your path to a secure retirement today!

-

All Accounts Feature 24/7 Online and Mobile Access

Retirement Certificates of Deposit (CDs)*

Get ready to have some fun earning with your money. With our Retirement CDs, you can take the guesswork out of investing by knowing that even during economic uncertainty, you’ll have a guaranteed return. And with rates that are great and no hidden fees, it’s a win-win! Add to your Retirement Accounts yearly, either Roth or Traditional, in accordance with the IRS’ contribution limits. Find one just right for you!

Features

- Earn Interest That Compounds Daily

- Automatic Renewals at Maturity

- Enjoy Steady Growth Throughout the Term

Roth IRA Option for All Retirement Accounts

With Roth IRAs, you can experience tax-free investment growth and potentially avoid taxes on withdrawals at age 59 ½ since your contributions (deposits) are pre-taxed. There is no obligation to withdraw funds during your lifetime allowing your money to continue growing. To withdraw funds tax-free, you must have a Qualified Distribution. Before making any decisions about your retirement, consult a professional tax advisor.

Features

- No Age Limit to Contribute

- No Required Minimum Distributions

- Contributions are not Tax Deductible

IRA Statement Savings*

Maximize your retirement savings with high interest rates! Our IRA Statement Savings Account offers the flexibility to make contributions on your preferred schedule. Choose between a Traditional or Roth IRA to start saving for your retirement today!

Features

- Make Additional Deposits at Any Time

- Use Online Banking or Mobile Banking to Manage Finances on Your Time

Traditional IRA Option for All Retirement Accounts

A Traditional IRA offers two tax benefits: You can deduct contributions from your taxable income and the interest grows tax deferred. This means you only pay taxes on your IRA balances earnings when you withdraw. Before making any decisions about your retirement, remember to consult a professional tax advisor.

Features

- Grow Potential Earnings Tax Deferred

- Current Year Contributions may be Tax Deductible

- Potential Taxes on Withdrawals in Retirement

Premier Money Market IRA*

Benefits before and after retirement! Our Money Market IRA offers competitive tiered interest rates and the flexibility to contribute money whenever you like within IRS rules. Available in Traditional or Roth IRA.

Features

- Make Additional Deposits at Any Time

- Use Online Banking or Mobile Banking to Manage Finances on Your Time

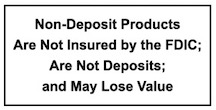

*Disclosures and Customer Notice

*Depositors of Individual Retirement Accounts are Insured by the FDIC up to Applicable Limits. Retirement Accounts are available in Traditional or Roth options including: IRA Statement Savings, Premier Money Market IRA, and Retirement CDs.

Customer Notice: This information is valid as of tax year 2024 and is intended to provide general information concerning federal tax laws governing IRAs. It is not intended to provide legal advice or to be a detailed explanation of the rules or how such laws may apply to your individual circumstances. For specific information, including potential tax penalties on distributions before age 59 1/2, and contribution limits, you are encouraged to consult your tax or legal professional.